does north carolina charge sales tax on food

If the service you provide includes creating or manufacturing a product you. Food is exempt from the State portion of sales tax 475 but local sales taxes Articles 39 40 and 42 do apply to food to make up a 2.

Do You Have To Pay Sales Tax On Internet Purchases Findlaw

Certain items have a 7-percent combined general rate and some items have a miscellaneous.

. Web While North Carolinas sales tax generally applies to most transactions certain items have special treatment in many states when it comes to sales taxes. Web The State of North Carolina charges a sales tax rate of 475. Web Is Food Exempt from Sales Tax.

Prescription Drugs are exempt from the North Carolina sales tax. According to North Carolina law youd be required to charge the full Murphy NC sales tax. Web North Carolina counties may add a sales tax of up to 275 percent tax.

Web What transactions are generally subject to sales tax in North Carolina. Typical county total taxes are 675 to 7 percent. This page describes the.

Web If you need access to a database of all North Carolina local sales tax rates visit the sales tax data page. In the state of North Carolina sales tax is legally required to be collected from all tangible physical. Web A customer buys a toothbrush a bag of candy and a loaf of bread.

Web Services in North Carolina are generally not taxable with important exceptions. Web Qualifying Food A 200 local rate of sales or use tax applies to retail sales and purchases for storage use or consumption of qualifying food. Web The North Carolina state sales tax rate is 475 and the average NC sales tax after local surtaxes is 69.

Web North Carolinas general state sales tax rate is 475 percent. The counties with the highest combined. Counties and municipalities in North Carolina charge additional sales tax with rates between 2 and 275 for a.

States That Still Impose Sales Taxes On Groceries Should Consider Reducing Or Eliminating Them Center On Budget And Policy Priorities

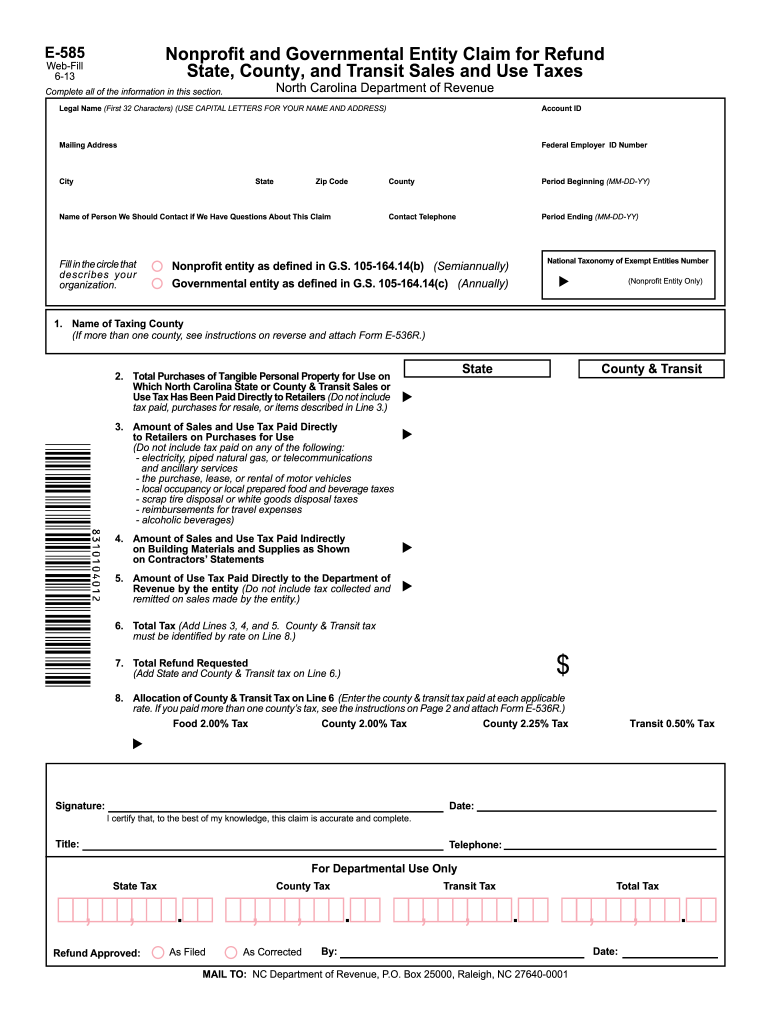

Form Nc Department Of Revenue Fill Out Sign Online Dochub

General Sales Taxes And Gross Receipts Taxes Urban Institute

Nevada Sales Tax On Restaurants And Bars Sales Tax Helper

Sales Taxes On Soda Candy And Other Groceries 2018 Tax Foundation

How To Charge Sales Tax In The Us A Simple Guide For 2022

Sales Taxes In The United States Wikipedia

How To Start An Llc In North Carolina Tailor Brands

2021 Sales Tax Rates State Local Sales Tax By State Tax Foundation

Online Sales Tax In 2022 For Ecommerce Businesses By State

General Sales Taxes And Gross Receipts Taxes Urban Institute

Sales Taxes On Soda Candy And Other Groceries 2018 Tax Foundation

How Do State And Local Sales Taxes Work Tax Policy Center

:max_bytes(150000):strip_icc()/best-and-worst-states-for-sales-taxes-3193296_final_CORRECTED-4d56f8efcd264f53981a40415c0e6de3.png)

The Best And Worst States For Sales Taxes

A Monthlong Sales Tax Holiday On Groceries In Tennessee Business Johnsoncitypress Com

North Carolina Government Plans To Collect Taxes On Food Ticket Sales At Universities Elon News Network

State Sales Tax Collections Per Capita Tax Foundation

Historical North Carolina Tax Policy Information Ballotpedia